Types Of Forex Accounts Explained

Содержание

Even though they go by several names, some of them share the same characteristics and can be grouped under the same category. The most important factor to consider when choosing a forex broker is that the broker is regulated. It is still possible for traders to open an account with an unregulated broker, but there is a considerable risk that you may not be able to get your money back.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 74% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. 67% of retail investor accounts lose money when trading CFDs with this provider.

Once logged into the account, you are taken through to their Watchlists page where you are then asked to “Complete Your Profile”. However, there is also an added extra where you can get the personal touch too. Forex.com offers access to a market strategist that can help you to devise a trading strategy.

Is Regulation Important For A Forex Broker?

A Standard Forex Account allows you to typically trade in standard lots which is 100,000 units of the base currency . However, for traders with a lower tolerance for risk, there are also Mini and Mico Forex Accounts available. A Forex account is necessary to trade as it connects you to the market. It allows traders to analyze currency pairs, determine profitable trading opportunities, buy, sell, and hold assets to increase your account balance consistently over time. With over 20 million registered users, eToro has grown enormously over the years and is now a huge presence amongst the world’s largest forex brokers. So for the conscientious trader, monitoring positions can be a 24-hour job.

However, traders need to weigh the impact of the cost of commission before opening an ECN account. However, if you start trading forex by using a demo account, it gives you the freedom to play with the platform to see what it can do. It is also a good time to test out how well your trading strategy works.

- Richard Perry is an independent market analyst for Perry Market Analysis.

- Most importantly it means that you can make these elementary trading mistakes free in the knowledge that they will not cost you a penny .

- Furthermore, if you are into your social trading platforms and automated trading platforms then you have everything you need on the eToro platform with their Copy Trader.

- Trust can come from knowing that your broker is fully regulated, has a strong reputation, and provides a strong level of customer service.

- However, for traders with a lower tolerance for risk, there are also Mini and Mico Forex Accounts available.

Traditionally the standard account would involve high commissions and needing large amounts of capital on account which would have restricted traders in the past. However, with the huge increase in popularity of forex trading, brokers have removed many of these restrictions. Since the deregulation of the forex market, we have seen daily market turnover rise in astronomic fashion over the years, topping $4trillion.

A pip is the fourth decimal in a quote, and the quote currency refers to the second one listed in a pair. Examples include the EUR/USD, the most traded currency pair, the GBP/USD, the AUD/USD, and the NZD/USD. The Forex market is the most liquid financial market in the world, with daily turnover reaching $6.6 trillion as of April 2019, the latest official data.

However, Forex.com tops the lot with a vast selection of over 80 currency pairs to choose from! If you are looking to trade exotic currency pairs, then this is the place to do it. There is also an added bonus which will save you even more on costs. Traders on the Libertex platform can gain commission discounts on certain traded instruments. Depending upon the size of the account on deposit, discounts of up to 50% are available.

It means that instead of the broker dealing with the risk of the position internally, the exposure for the trade is passed straight through to its liquidity providers. The broker will make its money by adding an amount to the spread of the trade. There is another aspect to consider when trading with a Standard Forex Account. Unless it is specified in some other way, the trade execution of this account will likely be done via a broker’s “dealing desk”. A dealing desk is the method of how the broker deals with their own risk or exposure of a trader’s position.

Try A Demo Account

For Muslim traders, the payment of interest is considered to be “haram” . That is a problem in forex trading primarily because standard trading accounts are subject to interest charges. Overnight financing rates can subtract or add interest to positions held overnight. To overcome this issue and to cater to a vast pool of Muslim faith traders, brokers have devised Sharia-compliant Islamic Forex Accounts.

When you open an account with us you’ll take advantage of the security, stability and strength that you’d expect from a global leader in forex trading. Choose from spread-only, fixed commissions plus ultra-low spread, or STP Pro for high volume traders. Please make sure your comments are appropriate and that they do not promote services or products, political parties, campaign material or ballot propositions.

Forex Com Trading Platforms

It promotes incremental portfolio growth and allows for increased learning potential. A forex broker can offer retail clients the opportunity to trade currency pairs on margin through either spread betting accounts or forex CFD accounts. It is this opportunity for trading on margin which is so enticing for retail traders. The amount of leverage available through CFD brokers can range from maybe 20 or 30 times up to many hundreds of times. Just as not all fingers are equal, so also forex accounts are varied in terms of funding requirements, specification, usage and a host of other features. On the platforms of forex brokers, there are different https://xcritical.com/ and we shall give a brief overview of some of them.

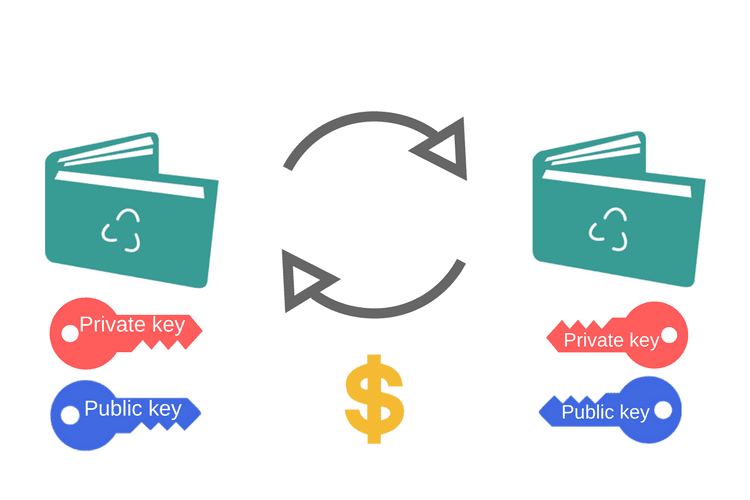

Over the years, many Forex brokers have been fined for non-compliance, even though they ultimately maintain their regulation. Once you have made a decision on the type of account you would prefer to use, the next decision to make is of which broker you would like to trade with. Here are three brokers that Trading Platforms believe to be some of the best around. PAMM – This is where the fund performance and fees are distributed through an equal percentage basis, according to the account size of investors in the fund. An ECN (“Electronic Communication Network) account is effectively an extension of the STP model. Instead of the broker pushing the trade onto its liquidity providers , the trade via an ECN account is pushed out into the broad market.

Mini & Micro Forex Accounts

For the trader, the benefit of this is that spreads can be razor-thin or perhaps even zero . However, to offer these accounts and still make money, the broker will add a commission to each trade. As with the STP account, this is a more transparent way of trading forex.

It continues to grow in popularity with a steady inflow of new retail traders competing against banks, hedge funds, and other institutional traders. Furthermore, if you are into your social trading platforms and automated trading platforms then you have everything you need on the eToro platform with their Copy Trader. This is a platform where traders can get the best from social trading by choosing to copy some of the best traders around.

The counterparty to trades are anonymous and could be institutions such as big banks or hedge funds. For traders who are seeking ultra-tight spreads with fixed commissions. Intermediate account holders are given bonuses by brokers, usually from 50% and even up to 100% on all new account deposits. Some brokers may extend a few other bonuses but this is not a constant. It materially reduced the competitiveness of Forex brokers operating out of Cyprus under the oversight of theCyprus Securities and Exchange Commission . It was the go-to country for a bulk of retail Forex brokers but has lost its edge.

These are institutional traders buying and selling currencies between themselves. In the spot forex market, the transactions are settled for delivery between two counterparties on a T+2 basis . Flexible account types give you the option of choosing a pricing model that best suits your trading style. Adam is an experienced financial trader types of brokers who writes about Forex trading, binary options, technical analysis and more. A Forex trader doesn’t necessarily have to pick the Forex broker he has his demo account with, but it definitely is more convenient. What this does is allows the Forex trader to switch back and forth between his demo account and his Forex real account seamlessly.

Stp Forex Accounts

It offers investors the freedom to select several asset managers, diversify their portfolio and risk profile, without having to learn how to trade or spend hours analyzing and watching markets. Finding the right asset managers can pose a challenge and should not be rushed. Proper choices will place the desired capital in professional care, and investors must not underestimate the long-term benefits. However, it is important to understand that you will not be trading crypto CFDs, you are trading the underlying asset. Retail traders are no longer able to trade cryptocurrency CFDs through UK-regulated brokers .

Find The Best Broker For You

Metatrader 4 is considered the benchmark and is a very popular platform, with availability through almost every broker you can find. However, brokers are increasingly trying to set themselves apart by offering proprietary forex trading platforms. These platforms often have increased functionality compared to MT4. It is always a good idea to trade on the demo platforms before deciding which one to use.

Vip Forex Accounts

An ECN account grants traders superior pricing with raw spreads, but it is offset by a commission per lot. It is ideal for high-frequency traders, but generally only available as a standard account. It depends on the type of trader, but most are best served from a mini trading account where each lot equals $10,000 with a pip value of $1. In managed accounts, investors sign over control of their account to a forex fund manager who trades their account for them. The investor still has an element of control as they retain the power to withdraw their money and opt-out whenever they choose to. If you are a beginner or relatively new to forex trading, you will make elementary mistakes in your trading.

A hybrid account, which incorporates managed accounts, offers traders a superior multi-faceted approach. Never invest money that you cannot afford to lose into a product that you are not comfortable with, that you do not fully understand, or feel pressured into via aggressive marketing. Take your time, be patient, find the most acceptable solution to your need, and build a profitable approach to Forex trading. Several brokers offer micro trading accounts, where the lot size totals just $1,000, and the pip value resembles $0.10. It is an ideal substitute for a demo account, as traders will be able to learn how to trade in a live trading account with a small deposit of $100 or less.

Ecn Forex Accounts

A 100 pip move against your position will result in a $1,000 loss. The minimum lot size is usually set between 0.01 lots and 0.10 lots, allowing for greater flexibility, but for that purpose, a mini trading account is better suited. Intermediate accounts usually have the greatest variation in terms of account nomenclature. In some quarters, it is known as the Standard Account, Gold account, the Classic account, etc.

A demo account is ideal for testing new strategies and automated trading solutions. This article will focus on the three primary choices, which will cover most Forex traders. A Standard Forex Account is the most basic form of forex trading account you can get through a forex broker. The reason it is referred to as a “Standard” account is historically due to the lot size of 1 Standard Lot that was available to be traded.

Stay informed with real-time market insights, actionable trade ideas and professional guidance. Trade a wide range of forex markets plus spot metals with low pricing and excellent execution. If you are a beginner trader worried about blowing your account quickly, then perhaps start with a Mini or Micro Trading Account. When you’re happy, you can then work your way up to a Standard Trading Account. When you have chosen your username and password you can complete the sign-up process.

There are traders who can comfortably come up with $100,000 for trading and can trade position sizes of up to 3 or 5 Standard Lots (equivalent to $30 to $50 per pip) very comfortably. There are other traders who will be hard pressed coming up with even $100. If we had a market which only allowed the high rollers access to the market while locking out the small-capital traders, would this create a fair atmosphere in the financial markets?